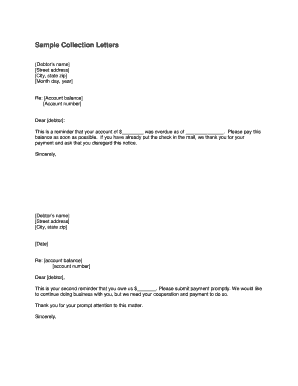

In either case, there is always a “deadline,” and if that milestone does not happen, it may be time for a collections agency to take over. Perhaps this customer will have also received an extension. One potential protocol is to send customers to collections at 90-days past due unless the customer has a valid need to postpone or there has been a simple billing error.īy this time, the customer would have received automated payment reminders, a personal note, a phone call, and many options to resolve payment.

#Collecting past due invoices full#

A client that is experiencing cash flow problems may need some understanding on your part.įor example, the client may agree to pay monthly installments, enabling you to collect the full amount at some point while preserving the business relationship. Your decision about lateness may be influenced by how much you value the customer and their history of paying prior invoices for example, a customer may pay late habitually, but if they always pay in full eventually then you may not need to worry.Īs soon as this late period has passed, follow up with a second (“past due”) invoice or a telephone call. 30 days beyond the expected payment date). When creating your service agreement, set your company’s policy on what constitutes “lateness” (e.g. If you’re in a service business and use the cash method of accounting, you can’t deduct the unpaid amount, and all your labor is wasted. Īfter all, outstanding accounts receivable ( unpaid invoices ) are not like fine wine: They don’t get better with age. This makes it a necessity to be proactive in pursuing payments from delinquent clients. If your invoices don’t get paid, your business’ cash flow falters, and stagnant cash flow is a direct path to business failure. But what if that doesn’t happen, and you end up with unpaid invoices?

You work hard to generate sales and expect to be paid in a timely manner.

0 kommentar(er)

0 kommentar(er)